What is a Community Land Trust?

How does it work?

How can someone become a CLT homeowner?

Can a homeowner make improvements to CLT properties?

What happens when a homeowner sells a CLT home?

Can a CLT homeowner pass their home to a relative?

Information for Lenders

What is a Community Land Trust (CLT)?

Community Land Trusts (CLTs) provide a path to homeownership by lowering costs and ensuring that future households will have the same homeownership opportunities.

Community Land Trusts provide:

- A new way to help families afford homeownership now and in the future.

- A neighborhood asset that ensures there will always be an affordable option.

- A path to inclusive generational wealth-building.

CLTs have origins in the civil rights movement of the 1960s. They have been used for decades to provide wealth-building opportunities for households excluded from the traditional housing market.

To learn more about Community Land Trusts, visit the Grounded Solutions Network.

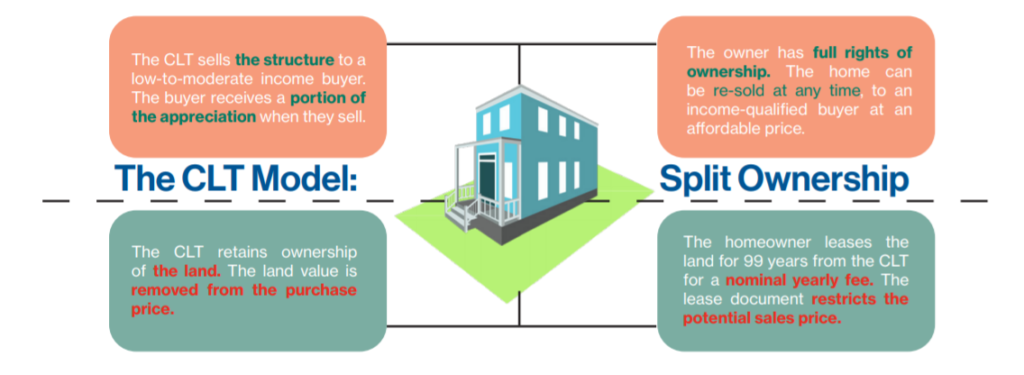

How does it work?

- Community Land Trusts modify the normal process of homebuying to make housing permanently affordable.

- The homebuyer purchases the house, and pays $100 a year to lease the land under a 99-year lease.

- In many ways, CLT homeownership is like conventional homeownership:

- The homeowner earns equity through the down payment and monthly mortgage payments.

- The homeowner is responsible for all maintenance and taxes on the home.

- The house is inheritable.

- When the homeowner is ready to move, they can sell the home to an eligible buyer.

- Much like a condominium structure, CLTs involve both private and common ownership.

- In a condominium structure, the homeowner owns the interior of a unit but not the building or the grounds; they often share access to and maintenance responsibility of common areas with other owners.

- A CLT homeowner owns the entire home and has full access to the land. The homeowner is fully responsible for maintenance of both home and land.

How can someone become a CLT homeowner?

- Applicants must be income qualified in order to purchase a CLT home.

- In order to prepare for success in homeownership, CLT homebuyers must participate in homeownership education and orientation.

- Homebuyers need to work with a pre-approved lender.

Can a homeowner make improvements to CLT properties?

Yes — but some improvements need to be approved by the board, depending on the scale. The process is similar to that of a Homeowners Association.

What happens when a homeowner sells a CLT home?

- In the same way that the initial homebuyer must be income qualified, CLT homes require that future buyers meet the same eligibility requirements as the first.

- The resale price is determined by a formula in the ground lease, which ensures that the new sales price remains affordable to future buyers. The homeowner receives a portion of the appreciation, as well as any equity they have accrued through their down payment and regular mortgage payments.

- A new household has access to affordable homeownership through the CLT model.

Can a CLT homeowner pass their home to a relative?

Yes! CLT homeowners can pass their home to immediate family members who will make the home their permanent residence.

Information for Lenders

Once the basics of the Community Land Trust model are understood, lenders should find that the underwriting of CLT loans is really no different than conventional, fee-simple home buying. The key difference between fee-simple homeownership and CLT homeownership is the Ground Lease. Learn more about the key components of the Ground Lease here.